Understanding Cap Rate and Its Importance

Investing in real estate involves various financial considerations, and one crucial metric for assessing the profitability of an investment is the Capitalization Rate, commonly known as the Cap Rate.

Calculating Cap Rate

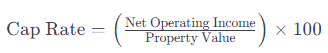

To calculate the Cap Rate, you need two key inputs: the Property Value and the Net Operating Income (NOI). The formula for Cap Rate is as follows:

This formula expresses the relationship between the property’s income and its market value.

Using the Cap Rate Calculator

This Cap Rate Calculator simplifies the process. Enter the Property Value and Net Operating Income, then click the “Calculate” button. The result will be displayed in the “Capitalization Rate” field.

Understanding the Results

The Cap Rate is expressed as a percentage. A higher Cap Rate indicates a potentially higher return on investment, but it may also imply higher risk. Conversely, a lower Cap Rate may signify lower risk but may result in a lower return.

Factors Affecting Cap Rate

Several factors can influence the Cap Rate, including market conditions, location, property type, and financing terms. Investors should consider these factors to make informed decisions.

Common Uses of Cap Rate

1. Investment Comparison: Cap Rate allows investors to compare different investment opportunities by providing a standardized metric for evaluating potential returns.

2. Market Trends: Monitoring changes in Cap Rates over time can offer insights into market trends and help investors make strategic decisions.

Key Considerations for Investors

When using the Cap Rate Calculator, keep in mind the following considerations:

1. Accurate Inputs:

- Ensure accurate figures for Property Value and Net Operating Income to get reliable results.

2. Market Knowledge:

- Understand the market conditions and factors influencing Cap Rates in the specific area.

Conclusion

The Cap Rate Calculator is a valuable tool for real estate investors, providing a quick and effective way to assess the potential return on investment. By understanding the formula and considering key factors, investors can make informed decisions that align with their financial goals.