Cc Rev to Gpm Calculator: Managing Credit Wisely

In the realm of personal finance, understanding the relationship between your credit card revolving balance and credit card limit is essential. The Credit Card Revolving to Gross Payment Margin (GPM) Ratio is a key metric that sheds light on your credit utilization habits. Let’s explore how to use the Cc Rev to Gpm Calculator and why it matters.

How to Use the Calculator:

- Credit Card Limit Input:

- Label: Credit Card Limit

- Input Type: Number

- Placeholder: Enter credit card limit

- Revolving Balance Input:

- Label: Credit Card Revolving Balance

- Input Type: Number

- Placeholder: Enter revolving balance

- Calculate Button:

- Type: Button

- OnClick: calculate

- Reset Button:

- Type: Button

- OnClick: resetForm

- Result Display:

- Label: Cc Rev to Gpm Ratio

- Input Type: Text (Readonly)

Understanding the Formula

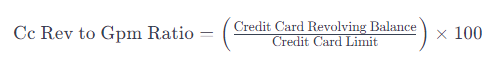

The Credit Card Revolving to GPM Ratio is calculated using the formula:

This ratio, expressed as a percentage, highlights the proportion of your credit limit that you are currently utilizing. A lower ratio is generally considered healthier.

Why It Matters

- Credit Score Impact:

- A high ratio may negatively impact your credit score, as it suggests a higher reliance on credit.

- Financial Health Indicator:

- Monitoring this ratio provides insights into your overall financial health and credit management.

Optimize Your Credit Utilization

- Pay Down Balances Regularly:

- Strive to pay down your credit card balances regularly to maintain a lower ratio.

- Understand Your Limits:

- Be mindful of your credit limits and avoid maxing out your credit cards.