Understanding Net Fixed Assets Calculator

What are Net Fixed Assets?

Net fixed assets represent the total value of a company’s long-term tangible assets after deducting accumulated depreciation. These assets include property, plant, equipment, and other fixed assets that are expected to provide economic benefits over multiple accounting periods.

How to Use the Calculator

- Initial Investment: Enter the initial cost of acquiring fixed assets.

- Accumulated Depreciation: Input the total depreciation accumulated over time.

- End Value: Specify the current market value of fixed assets.

- Calculate: Click the “Calculate” button to compute the net fixed assets.

- Result: The calculated net fixed assets will be displayed.

Formula for Calculating Net Fixed Assets

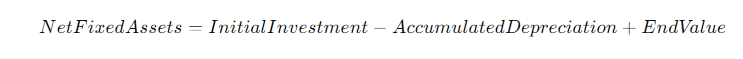

The formula for calculating net fixed assets is:

Where:

- Initial Investment: The original cost of acquiring fixed assets.

- Accumulated Depreciation: The total depreciation recorded on fixed assets.

- End Value: The current market value of fixed assets.

Importance of Net Fixed Assets

Net fixed assets are essential for assessing a company’s financial health and operational efficiency. They provide insights into the value of long-term investments and the extent to which fixed assets contribute to generating revenue over time.

Analyzing Net Fixed Assets

- Investment Decisions: Helps in evaluating the effectiveness of capital investments.

- Financial Reporting: Forms a crucial component of balance sheets and financial statements.

- Performance Evaluation: Indicates the efficiency of asset utilization and depreciation management.

Conclusion:

In summary, the net fixed assets calculator provides a straightforward method for determining the net value of a company’s long-term tangible assets. By considering factors such as initial investment, accumulated depreciation, and end value, this tool aids in financial analysis and decision-making processes.